In today’s post, I’m going to write about a recent software project that has taken the geek world by storm: Bitcoin, the cryptographic cybercurrency. I’m going to discuss the general aspects of Bitcoin today, and I’ll leave some of the technical aspects for a future post. If you haven’t heard about Bitcoin yet, it is a form of electronic currency that can be used for online payments. This video from www.weusecoins.com gives a very basic introduction:

And this is another interesting video on YouTube, where Jerry Brito explains some of the key points about Bitcoin:

I first read about the Bitcoin project last April thanks to a Facebook post by my friend Dan Tomlinson. After reading up a little bit on it, I could see that the idea behind Bitcoin was simply brilliant. In fact, the more I think about it, the more I tend to be convinced that bitcoins represent a concept of money that could be superior to the current fiat money like the euro or the US dollar. Just like a combination of government support and convenience made fiat money supersede commodities like gold and silver as the common form of money in the 20th century, it is possible that more reliable forms of money may end up replacing fiat money during the 21st century. After all, the essence of money is simply confidence, and bitcoins could similarly replace the current currencies if people eventually start to trust bitcoins more than the euros and dollars of our day. Whether that kind of trust eventually builds up will depend not so much on people understanding the difficult mathematical and cryptographical concepts behind Bitcoin, but rather on whether people find bitcoins convenient and safe to use.

During the last few weeks there have been some high-profile cases of bitcoin theft and the best-known Bitcoin exchange site (Mt. Gox) had its database compromised. All the recent bad news has made a lot of people question the safety of bitcoins. But it is important to understand that the Bitcoin technology is still in its infancy. Securing and backing up one’s bitcoin fortune still requires some above-average computer skills, but this will change in the future with more advanced Bitcoin clients and when Bitcoin banks and Bitcoin-based physical coins or notes, all of which already exist, start to gain widespread use. As I will try to argue in this post, I think the technology is sound, and bitcoins may indeed be the money of the future.

The ideas behind Bitcoin (public-key cryptography, peer-to-peer decentralised network, and verification based on time-consuming proof-of-work) and the way they are combined are really awesome. The only other technological project I can think of that has made such a profound impression on me because of its sheer brilliance is the Reprap project of the 3D printer that replicates itself. These are the kinds of ideas that make us stand in awe at the capacity of human ingenuity. Maybe by 2100 our grandchildren will just download their furniture from an open-source online catalogue of designs that can be reprapped at home, and then tip the designer a few bitcoins.

In order to understand Bitcoin better, let’s start by asking the basic questions: What is a cybercurrency? How did Bitcoin come about? How does it work?

1. Concept of cybercurrency or e-currency

First of all, we need to clarify what we mean by a cybercurrency or e-currency. The fiat currencies that we use in everyday life can be regarded as electronic currrencies in their present form. When, for example, funds from a US bank are transferred to a bank in the Eurozone, the bank in the US will simply subtract an amount of dollars from the total credit in the sending account, and the market exchange rates will be applied to that figure, so that the balance in the Eurozone account will be incremented with the resulting amount in euros. When such a bank transfer takes place, there are no large suitcases of dollar and euro banknotes being exchanged by bank representatives. In fact, most financial operations nowadays are pure arithmetic operations on electronic bank balances, and the amount of money that makes it into coins and notes is actually a tiny part of the total amount of money that circulates. Today, the coins and notes in our pockets are a token for the ‘real’ electronic monetary amounts rather than the other way around.

So, a project like Bitcoin is not simply about the electronic representation of money, but rather about a more radical approach to the source of legitimacy for a currency. At present (2011) the currencies we use are all issued by a central authority known as a ‘central bank’. Only a central bank can decide to create or destroy money, and these decisions about the total volume of money that should be circulating depend on the particular aims that the central bank identifies as its ‘mandate’. For example, the European Central Bank (ECB) has a mandate which is extremely simple: year-on-year inflation in the Eurozone should be between 0 and 2 percentage points. If the Eurozone were to enter deflation, the ECB could resort to ‘printing’ money (or ‘expanding the monetary supply’ in more technical jargon). This is done by electronically adding an amount of new money to its total reserves and using this new money in open-market operations (typically buying securities such as European government bonds in order to make the price of such securities rise; this mechanism injects a source of inflation into the system that can eventually counteract the unwanted deflation). In the more common scenario when inflation across the Eurozone exceeds the 2% target, the ECB can raise the interest rate of its short-term loans to commercial banks in its role as a lender of last resort, which makes lending money more expensive and puts a brake on inflation. In the United States, the Federal Reserve (the American central bank) adheres to a different mandate based on employment and growth, but the idea is essentially the same: a set of criteria is identified, and a group of people who run the central bank hold meetings where they decide whether those criteria are being met and decide on interest rates and market operations that affect the total supply of money. A weakness of this system is that fiat money tends to be inflationary, since there is usually much more pressure to create money from both government and society (to finance government deficits for example) than to destroy it, so the supply of money in a fiat system always grows, and this can lead to high inflation, a consequence of the value of money itself being debased. The human factor introduces a source of possible abuse of the system, which didn’t happen when gold or silver were the monetary standards.

So, the idea of a cybercurrency like Bitcoin is not simply about the electronic representation of money, but also about eliminating the need of a central authority that has full power over the creation of money. In the Bitcoin system, money is created according to an algorithm that imposes a limit on the total amount of monetary units that can ever be created, and the transactions or payments are acknowledged by the whole network. This lack of human intervention is expected to make the value of bitcoins more stable as a store of value than the current inflationary fiat currencies. One of the main points of the debate surrounding Bitcoin is whether a currency without inflation is really a good thing. A common idea among economists is that deflation is bad because it leads to hoarding, but I think that’s only the case when deflation is perceived to be short-lived, not if it is a permanent trait of a currency (after all people don’t stop buying mobile phones or laptops just because they will be cheaper next year). Michael Suede has written a convincing article The Economics Of Bitcoin – Why Mainstream Economists Lie About Deflation about how deflation is not necessarily a bad thing at all.

A cybercurrency independent from government control can become successful if it gains the confidence of a sizeable number of people who regard it as better money than the legal-tender currency. And this is already happening with Bitcoin, little more than three years after it was designed by an unknown software engineer going by the name of Satoshi Nakamoto.

2. The origins of Bitcoin

Bitcoin was created by an unknown person using the pseudonym Satoshi Nakamoto, who in 2008 wrote a paper that built on previous ideas about electronic money by Wei Dai, Nick Szabo, David Chaum and Hal Finney. In that seminal paper, self-published on the web, Satoshi Nakamoto described how to solve the difficulty of time-stamping transactions and preventing the double-spend problem, and how to store histories of transactions in an efficient way by using Merkle trees. In what is a remarkably short paper, Satoshi Nakamoto solved the major technical issues about a purely electronic representation of money. Non-biased critics of Bitcoin should at the very least acknowledge the technical brilliance of Satoshi Nakamoto’s ideas. Even if the ideas themselves had been around for some time (see for example the Joining Clouds article in the references below), Nakamoto was the first one who put all the pieces together in order to produce the cleverest form of e-money ever devised.

Very little is known about Satoshi Nakamoto, who started the technical description of Bitcoin as well as the first version of the Bitcoin client software, and was very active in the Bitcoin forum at the beginning, but has gradually disappeared from public exposure as the Bitcoin project has attracted new collaborators. It seems clear that ‘Satoshi Nakamoto’ is a pseudonym because there are no references to anybody with that name in the computing or mathematical literature, and even though he (who is apparently male) uses a Japanese name, everything Nakamoto’s written is in perfect English (and British English in particular, based on his spelling). He was active in the Cypherpunks and Cryptography mailing lists and he has never written anything in Japanese, so the best guess is that Satoshi Nakamoto must be a native speaker of English and an expert in cryptography who has chosen to keep anonymous and hide his true identity.

3. What is Bitcoin?

Bitcoin is basically a peer-to-peer network protocol. Just like in a file-sharing system such as BitTorrent the different nodes exchange lists of available files, in the Bitcoin network a client running on a computer will connect to other clients found throughout the network. The information shared across the Bitcoin network consists of transactions of units among accounts. So, if the Bitcoin system recognises a particular account A as having a credit of 10 units, and a transaction is carried out that transfers 3 units to another account B, originally empty, the new balance after the transaction will be 7 units in account A and 3 units in account B. These accounting units are also referred to as ‘bitcoins’ (here I use ‘Bitcoin’ with a capital ‘B’ to refer to the system, and ‘bitcoins’ with a small ‘b’ to refer to the units). We can then say that the person that holds account A has paid 3 bitcoins to the person who holds account B. This information about credit balances in accounts and the transactions that modify the balances in those accounts is the data that the Bitcoin network handles. It is obvious that this mechanism has all the characteristics of money.

The advantage of a peer-to-peer network over a centralised one with a server is that in a peer-to-peer network the information is shared by all nodes, so there is not a single point of failure, as would be the case of a server in a centralised system, where the whole network can be rendered useless if the server goes down. This is the reason why file-sharing systems are all peer-to-peer. A government may clamp down on a server from where all the information emanates, but it can’t shut down a peer-to-peer network as long as any clients for that network exist anywhere in the world. This impossibility of a government clampdown is one of the strong points of Bitcoin. Because all the information about monetary transactions is distributed across the network and there are people running Bitcoin clients all around the world, it’s not really possible for a government to shut down Bitcoin, even if it could make certain uses of it illegal.

4. Does a cybercurrency like Bitcoin make any sense?

It actually does. When first hearing about bitcoins, a lot of people’s initial reaction is that the concept can’t work or doesn’t make any sense. This attitude usually stems from a misconception of what money actually is. People tend to think that money must have some inherent ‘value’, in the way that gold or silver can be used for ornamental purposes. But the use of gold and silver in jewellery is just the reason why these metals started to be valued first as commodities and then went on to be used as ‘money’. Once these metals acquired their status as money their uses in jewellery became secondary and, in fact, it is the monetary use of gold and silver as a store of value which explains why these metals have been so much valued in human history. If there have been so many conflicts and wars because of gold, it is not because of people’s love of bling, but because the possession of gold has traditionally given access to all sorts of goods and services. We can see that money doesn’t need to have any inherent non-monetary value if we think about the euros, dollars, pounds or yens that we use nowadays. What value does a 20-euro note have? You can’t eat it or use it in industry or medicine. Its value as paper is negligible. But we value 20-euro notes because we trust them; we know that we can go into a shop and buy something with one of those. We see people pay for services with those notes on a daily basis. We use those notes too and have never ever come across a waiter or a shopkeeper who rejects them. Even if most people don’t really understand how the legitimacy of fiat money has come about or how money is issued by central banks, people have no problems using it because there is universal confidence in the value of legal-tender money.

The key issue here is confidence. A cybercurrency can start to be used as real money (a medium of exchange and a store of value) if people trust it as such. Of course, for this confidence to build up, the cybercurrency must meet the general requirements of money (such as being easy to store and carry about, having a limited supply and being divisible), and it also needs to catch on among a community of users. In the case of money issued by governments, the trust was built in the past when such currencies were based on gold. Even when the link with gold was severed, the fact that people had got used to using them together with the legal-tender laws that require taxes and debts to be paid in the official currency have kept that confidence intact.

Can bitcoins generate the level of trust that would make them work as a currency? Well, the answer is that they already have. The fundamental use of money is as a medium of exchange, but another important use is as a store of value. While the use of bitcoins as a medium of exchange is still quite limited, the fact that the price of bitcoins in terms of euros or dollars has skyrocketed during the last few months has attracted a lot of people to the currency. I admit that I’ve never bought anything with bitcoins yet, but I’ve already moved a part of my savings to bitcoins. This is something that a lot of people have done, and the fact that you can sell your bitcoins for around 10 euros each (as of July 2011) in a number of markets means that some early adopters, like myself, are willing to give it a try and trust it as a store of value. Of course, there is the risk that this trust will eventually collapse if the Bitcoin project fails and falls into oblivion, but the impression I get is that confidence is in general increasing, despite the setback of the bitcoin-stealing virus that robbed an early adopter of BTC 25,000 and the security problems that have plagued the Mt. Gox exchange.

Needless to say, it is controversial whether a kind of money beyond the control of governments is really a good thing, but many supporters of Bitcoin adhere to the view that government and central bank intervention lead to the continuous debasement of money through inflation, and that a money with a fixed supply, like Bitcoin, is a better store of value. This is pretty much the idea of the economists of the Austrian School like Ludwig von Mises and Murray Rothbard, who argued extensively against inflationary fiat money and in defence of gold and silver as the optimal money that the market, were it not for government intervention, would have chosen. Bitcoin supporters tend to agree with the Austrian view but, unlike traditional Austrian economists, also think that a purely algorithmic money is superior to gold or silver. This is an idea I agree with. Metals like gold and silver are very valuable because of their traditional use as a store of value, i.e. money, but their value is also affected by industrial and other uses, and the total quantity of these metals may vary if new reserves are found, which would benefit the part of the world that is lucky to find those reserves. On the contrary, bitcoins have no non-monetary use at all and the way they are generated is completely algorithmic, and isn’t affected by natural discoveries. And of course payments with gold or silver require the physical transportation of the metal, whereas payments with bitcoins are electronic and only require a device connected to the Internet. In this respect, bitcoins have many of the advantages of government-backed fiat money, which also lacks non-monetary uses and can be transferred electronically, but is like gold in the sense that it can’t be created ex nihilo. Whereas the European Central Bank can ‘print’ euros at will, no-one has the alchemist’s power to create gold out of nothing. Like gold, bitcoins are a scarce resource, since they are created following a pattern that limits the total number of units that can ever exist. The maximum number of bitcoins is 21 million, and bitcoins are generated through a process known as ‘mining’ (an obvious analogy with extracting gold from nature), which consists in executing long calculations that require a lot of computing power. These calculations generate the transaction history that is shared by the nodes in the Bitcoin network. This information takes the form of a ‘block chain’, a sequence of bunches of data called ‘blocks’. Mining bitcoins is the process of attempting to generate these blocks that store the Bitcoin history. When a mining client manages to create a block, it currently gets 50 brand-new bitcoins as a reward, but this reward is scheduled to go down progressively as the number of bitcoins increases: 50 bitcoins is the reward for each one of the first 210,000 blocks, 25 bitcoins for the second batch of 210,000 blocks, and then the next 210,000 blocks get 12.5 bitcoins, and so on. This algorithm that halves the number of newly-coined bitcoins per block as the number increases by 210,000 is the reason for the asymptotic 21,000,000 limit.

The number of bitcoins that can ever exist is thus limited to a value under 21 million. In fact, the number of bitcoins in circulation will always be significantly lower than that since bitcoins can be lost forever. A Bitcoin account can be used to make payments thanks to a cryptographic private key. If this private key value is lost (for example because it was only stored on a computer that got destroyed in a fire), the associated Bitcoin account will be locked forever and no-one will be able to redeem those bitcoins even though the network is aware of the existence of that account. So, the fact that the Bitcoin algorithm limits the total number of possible bitcoins to 21 million combined with the fact that bitcoins may be lost forever means that the total supply of bitcoins will remain pretty stable after most of those 21 million bitcoins have been mined. At present (August 2011) the total amount of bitcoins that have been mined is nearly 7 million, so a third of all the bitcoins that will ever exist are already out there in circulation. Anyone can mine new bitcoins by running a bitcoin-mining program, but it takes a very long time for an ordinary computer to generate the blocks that store transaction information and that reward miners with a fixed amount of bitcoins (50 at present). With an ordinary computer, generating one of these blocks and getting the 50-bitcoin reward may take months or years, so the value of those bitcoins may be less than the resulting electricity bill. This is what makes Bitcoin mining a competitive activity, and only those who have very good GPU hardware can make a profit from mining. Of course, the cost of mining bitcoins also has a bearing on the price that bitcoins have in the markets where they get traded for other currencies, and this mechanism of money creation explains how bitcoins initially acquired a value in terms of US dollars or euros.

5. Where are bitcoins traded?

There are some Bitcoin exchange sites where bitcoins can be bought and sold for US dollars and other currencies. The two main exchange sites right now are Mt. Gox and Tradehill, which are based in the US, but offer Euro accounts too. Here in Spain I have bought bitcoins through Bitcoin.com.es, where you pay the amount in euros directly to a Spanish bank account, and they handle the operation through other international exchanges like Mt. Gox for a reasonable fee. Other services based in Europe that seem reliable, but I haven’t used them, are Intersango and Bitmarket.eu. Intersango is a sister site to Britcoin.co.uk, the main Bitcoin exchange site in the UK.

6. Is Bitcoin a bubble? Or a Ponzi scheme?

Right now a lot of people are buying bitcoins in the expectation that they will go up in value in terms of the common currencies, hoping that they will be able to sell them in the future at a handsome profit. This is certainly a trait of financial bubbles, so it is possible that Bitcoin may end up being a bubble. But the difference with other potential bubbles such as the property bubble is that bitcoins have only existed since 2008, so nobody really knows what the fair price for one bitcoin should be. There is simply no historic data to evaluate what a reasonable price for a peer-to-peer cybercurrency should be. In my opinion, there are two possible scenarios: 1) bitcoins become more widespread and their price in terms of the common currencies rises; this should enhance their use as a store of value and gradually as a proper medium of exchange, and 2) bitcoins turn out to be flawed for some reason (people simply don’t trust them or a better cybercurrency appears) and the whole system falls into oblivion. In the second scenario, the price of bitcoins would collapse all the way down to zero, and people who have bitcoins would lose all their investment. Even though I am among those who find the first scenario more likely, anyone investing in bitcoins must be aware that the second scenario is indeed possible. Bitcoins are an extremely risky form of investment.

Some people go as far as accusing Bitcoin of being a scam in the form of a Ponzi scheme. Their argument typically goes that because early adopters have been able to mine lots of bitcoins or buy them at a very low price, they can now sell their bitcoins at a higher price, thereby getting a lot of money thanks to the late adopters who have started buying bitcoins recently and paying a higher price for them. Now I don’t think this accusation makes much sense, since bitcoins don’t guarantee any kind of return. You can of course buy a thousand euros’ worth of bitcoins today and sell them one year from now, but whether you will make a profit or a loss will depend on how the market evolves. Unlike what happens in typical Ponzi schemes that cheat people out of their money, nobody has promised that buying bitcoins will yield any sort of return. It is a form of investment that can go right or wrong. People may buy bitcoins thinking that they will go up in value, as I have done, but it is the same sort of bet as buying some shares of a company in the expectation that their value will go up.

7. How much should one bitcoin be worth?

The value of the bitcoin has stabilised around 10 euros / 14 US dollars during the last weeks of July 2011, but it was worth just a few cents barely one year ago, so people are asking what the stable price of one bitcoin should be in the long run. It is difficult to answer that question because it basically will depend on how widespread the use of bitcoins becomes. We know that in a couple of decades there will be around 20 million bitcoins in circulation. Imagine there were just two people in the world using bitcoins. In such an extreme scenario, those 20 million bitcoins would be used solely for the exchange of goods between two individuals. We can expect that one bitcoin would be very little money if converted to euros (and only either of these two people would be willing to trade them, so the market would not be very liquid). As an alternative, and more realistic scenario, imagine instead that 20 million people were using bitcoins on a regular basis. Then the average fortune of each bitcoin user would be just 1 bitcoin. This means that one bitcoin would have to be a lot of money. As a comparison, the amount of US dollars and euros in circulation is in the order of magnitude of trillions. There are different ways of defining the ‘money supply’, but the more useful definition of the quantity of money in circulation is the M2 money supply, which includes both notes and coins and balances in bank accounts. The M2 supply for the eurozone is around 8 trillion euros (see the ECB’s Monetary Statistics). So, if bitcoins are ever used on the same scale of the euro (to cover a similar range of goods and services), we would need 20 million bitcoins to play the role of 8 trillion euros. In this case, the equilibrium exchange rate would be 400,000 euros to 1 bitcoin. Now this scenario may seem far-fetched, since the euro is used by more than 300 million people in their daily lives to buy everything from apples to cars and houses, pay taxes and so on. But bitcoins can be used globally, and even if their use doesn’t oust the official currencies, significant use by more than 7 billion people all over the world could take their exchange rate to those levels in the hundreds of thousands of euros.

A common misconception is that the limit of 21 million bitcoins is somehow an impediment for the use of bitcoin as a global currency, as if there will be ‘too few’ bitcoins. This is not so because the total amount of a commodity used as money is completely irrelevant as far as it can be subdivided, as Murray Rothbard convincingly argues in What Has Government Done to Our Money? (see II.8. The “Proper” Supply of Money on page 26). And bitcoin amounts, being plain numbers in digital form, can obviously be subdivided indefinitely. We can say that there are 20 million bitcoins (BTC) just as we can say that there are 20 billion millibitcoins (mBTC) or 20 trillion microbitcoins (μBTC). If bitcoins were to become a global currency, it is likely that a coffee would cost a number of microbitcoins or nanobitcoins, not full bitcoins (it would be absurd for the whole money supply to buy just 20 million coffees). Currently, there is a technical limitation that only allows 8 decimal places in Bitcoin amounts, but it should be possible to support further subdivisions in future versions of the software and the protocol, as far as I’m aware. A common discussion among Bitcoin users and developers is whether new names should be coined for millibitcoins and microbitcoins. Some people have even suggested redefining the word ‘bitcoin’ to mean a microbitcoin (see, for example, this thread in the Bitcoin forum).

8. How do you pay someone with bitcoins?

Satoshi Nakamoto developed the first version of the Bitcoin client in C++, which is the program that you can download from the Bitcoin.org site. The on-going development is an open-source project, and Nakamoto is no longer involved in the project (or not under that name, anyway). Since Bitcoin is just a protocol, it is possible to develop other clients, and there are projects for alternative Bitcoin clients. In a few years from now there will probably be a lot of programs that can handle Bitcoin payments, but right now it is better to stick to the original client provided by Bitcoin.org. There are versions for Windows, Linux and Mac OS X, and the source code is hosted on GitHub.

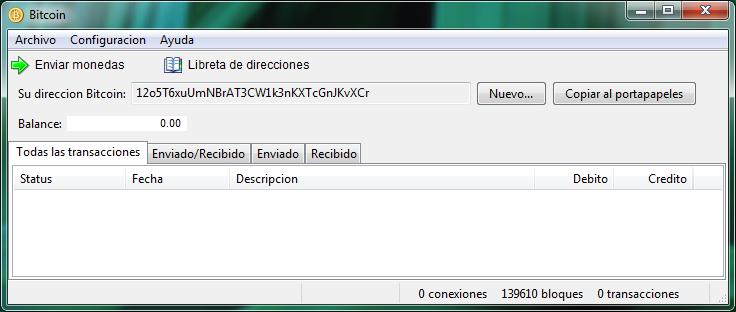

The Bitcoin client manages Bitcoin addresses that can be used to send or receive amounts of bitcoins. These Bitcoin addresses are made up of 34 letters and numbers currently starting with ‘1’ (for example, 12o5T6xuUmNBrAT3CW1k3nKXTcGnJKvXCr). This format for the addresses is based on the public key of a cryptographic key pair. The client manages these key pairs, which are the actual ‘users’ that send and receive Bitcoin money as far as the network is concerned. Rather than using just one address for all transactions, the client keeps on creating new addresses for new transactions. The use of different addresses for different payments is the mechanism that makes transactions anonymous, as I’ll explain below.

The Bitcoin client is very easy to use. If I want to sell you something for a few bitcoins, I only need to give you one of the Bitcoin addresses that my client shows, like 12o5T6xuUmNBrAT3CW1k3nKXTcGnJKvXCr, and you will have to run your client and click on the ‘Send coins’ button, which will open up a dialog where you can type or paste the address I’ve given you and type the amount of bitcoins you want to pay me. After you click ‘Send’, the transaction will be communicated to the network, and it will appear on the client’s user interface as having 0 confirmations. As the network generates new blocks with transactions, this particular payment will make it into one block and the number of confirmations will go up to 1. Then more blocks will be added to the chain and all these subsequent blocks that prolong the chain are regarded as additional confirmations. So the number of confirmations of a payment is simply the number of blocks in the global block chain minus the index of the particular block where that payment has been recorded. For example, if I make a payment when there are 139,000 blocks in the current block chain, then this payment should show up in block 139,001 or later (how soon it gets processed also depends on whether I voluntarily choose to pay a transaction fee, which is an incentive for block miners to process payments quickly). Let’s suppose the payment gets recorded in block 139,004, then this transaction will have 97 confirmations when there are 140,000 blocks in the chain. This number of confirmations simply keeps on growing indefinitely as the Bitcoin block chain grows. The Bitcoin client shows the transaction as ‘confirmed’ after it has received 6 confirmations, but this threshold is an arbitrary value used by the client based on the idea that after 6 blocks have been added to the chain it is extremely unlikely that those blocks will be reversed (something that could happen if there were some fraudulent attempt at double-spend and an alternative block chain ends up getting longer).

9. Securing one’s wallet

The current Bitcoin client software stores the information about the public and private keys that identify Bitcoin accounts in a file called wallet.dat. That file is stored in an application data directory where it is very easy for malicious software to steal it. A virus doing exactly that recently managed to steal BTC 25,000 from a user, so anyone handling large amounts of bitcoins should take extra care about securing and backing up the wallet.dat file. If you lose the wallet.dat file you will lose your money. Future versions of the client will add some form of encryption and maybe in future some system for remote backups, but for the time being users must take care of backing up their wallet files. Note that if you remove the wallet.dat file before running the Bitcoin client, a new wallet.dat file with different pairs of public and private keys will be generated. By renaming wallet.dat before starting the client you can have several wallets. You may want to generate a wallet.dat file just to copy a Bitcoin receiving address and then rename that file to savingswallet.dat or whatever. Then you can use a program like TrueCrypt to encrypt the file and copy it to several back-up locations. Note that an address generated by an offline wallet file can receive payments (you can check the credit in any address using the Bitcoin Block Explorer). It is only when you make a payment that the address must be online.

The difficulty of securing the wallet files is the most serious limitation of the Bitcoin system right now. A more secure and user-friendly client program is badly needed for Bitcoin payments to be accessible to the masses. As long as you need to manually access hidden directories, move files, encrypt them and back them up in remote servers or offline disks, managing bitcoins will remain a thing for the tech-savvy, not really ready for the average computer user.

10. Are Bitcoin payments anonymous?

Bitcoin transactions are recorded in the block chain, and this information is stored for ever by the network. This means that if a user pays 10 bitcoins to another user, that information is public and visible for anyone who cares to investigate the history of transactions. By using the Bitcoin Block Explorer, you can check the history of blocks and the transactions they have. So, at the level of the Bitcoin protocol, transactions are publicly recorded and they are not anonymous. Yet the Bitcoin protocol doesn’t see users like John or Mary, but rather Bitcoin addresses that are made up of cryptographic key pairs. Anonymity is possible because people can create multiple Bitcoin addresses and use different addresses for their payments. The current official Bitcoin client encourages this approach by producing new addresses for each payment. This two-level approach with accounts and human owners of those accounts is the basis of privacy in Bitcoin transactions.

We can use an analogy to understand this better. Let’s imagine a village where people communicate by sending letters to one another. Now the postman could see that John has written a letter to Emma today and that he wrote a letter to Mary yesterday. In this village, the postman knows who writes letters to whom. Now the post office builds a large building equipped with millions of PO boxes, and any villager can take as many boxes as they want. Now Emma can get a PO box just to ask John to send her a letter to it, and John uses a brand new PO box he’s never used before to use as the ‘sender’ address in the envelope. Now the postman will simply see that somebody claiming to use PO box 65,349 is sending a letter to PO box 163,946. All the information about who’s writing to whom is hidden in a multitude of PO box numbers. It is up to the villagers to decide whether to stick to one PO box for all of their letters, which would enable the postman to detect certain patterns, like PO box 142,527 writing to PO box 173,916 everyday, or to use a brand new PO box for each letter, which would give much stronger anonymity. This is basically how the Bitcoin system of public addresses works.

An additional way in which bitcoins could be exchanged anonymously in the future is through promissory notes. Just like the origin of paper money is in gold certificates that people trusted for payments because they were more practical than carrying gold around, it is possible that a company could issue notes that can be redeemed as bitcoins. In fact, there have already been attempts to do this, like bitbills, which are plastic bills that store the cryptographic key pair of a Bitcoin address inside them and the physical bills must be destroyed in order to access the keys and redeem the bitcoins. This possibility of promissory notes like bitbills would make it possible to use bitcoins for anonymous payments without any actual transaction in the Bitcoin network. A bitbill can change hands many times before somebody finally decides to destroy it, gain access to the actual bitcoin account contained within the bill and redeem the amount electronically. This possibility of promissory notes that get exchanged outside the Bitcoin network opens the way for bitcoins being used as money even for everyday transactions in the absence of electronic devices.

11. Risks faced by bitcoins

Even though I am quite optimistic about the future of bitcoins, I can see some potential problems lying ahead that could make the project fail:

- The concept turns out to be flawed and people don’t trust it. The system seems impressively robust right now, but it is possible that unknown issues may be found. For example, I am not completely clear about how it scales as the block chain grows. Even with the use of Merkle trees, the fact that the whole history of transactions must be present in the block chain may impose a penalty on performance as the system expands. Another question is whether the cryptographic security will still be secure when much more powerful quantum-based computers become available. And there is also the simple question of whether a significant number of people will really trust bitcoins. If a majority finds the concept less trustworthy than money backed by central banks, people may reject it because of the general lack of confidence.

- Governments try to ban bitcoins. If payment with bitcoins were to become common, governments might try to regulate its use, and they might even try to ban it since it represents a rival money to the legally recognised official currencies. Right now, buying something with bitcoins is a form of barter from a legal point of view. As far as I know, there is no legal difference between swapping a motorbike for 10,000 bitcoins or swapping it for ten tons of tomatoes. But bitcoins, unlike tomatoes, are only used as money, so it is unclear how governments will eventually regulate their use. I personally think it is extremely unlikely that government intervention may derail the Bitcoin project because of its nature as a peer-to-peer network, which should enable it to survive any government ban.

- An alternative cybercurrency becomes more successful. This is, in my opinion, the most serious threat to Bitcoin. If somebody devises a new form of cybermoney that turns out to be better, Bitcoin would flop as people start using the alternative currency. In that case, the value of bitcoins would collapse all the way down to zero. People holding savings in bitcoins would lose all their money, as it would be nothing more than fancy bunches of bits. Given the current success of Bitcoin, I doubt that an alternative cybercurrency may replace it, and I find it more likely that Bitcoin itself and the software that manages it will improve over time, but this is nonetheless a possibility to be reckoned with.

12. References

These are some articles I found very interesting while I was researching this topic.

- Bitcoin.org The official Bitcoin site.

- Bitcoin Forum.

- Bitcoin FAQ. Frequently asked questions in the Bitcoin wiki.

- Bitcoin: A Peer-to-Peer Electronic Cash System The original paper by Satoshi Nakamoto, self-published in the bitcoin.org site.

- Bitcoin v0.1 released Satoshi Nakamoto’s message on the cryptography mailing list, where he announced the first version of the Bitcoin client software on 9 January 2009.

- Bits and Bob A very good article about Bitcoin, in The Economist’s Babbage blog.

- Virtual money, from real central bank mistrust A post by Tracy Alloway in the FT Alphaville financial blog.

- Why are Libertarians against Bitcoin? A very interesting article by Jon Matonis about the conflicting views on Bitcoin among people who adhere to the Austrian school that criticises fiat money. The article has a lot of interesting links to other articles about Bitcoin and the nature of money.

- How To Use Bitcoin – The Most Important Creation In The History Of Man. An enthusiastic supportive view of Bitcoin by Michael Suede. The article also explains how to use bitcoins.

- Libertarian Goldbugs Hating On Bitcoin – Free Market Money. Great article by Michael Suede, in which he brilliantly debunks the idea that bitcoins are not money because they’re not a tangible commodity.

- The Economics Of Bitcoin – Why Mainstream Economists Lie About Deflation. Another great article by Michael Suede, who argues that deflation is not such a bad thing at all.

- Why I’m Putting All My Savings Into Bitcoin. An article by Rick Falkvinge, founder of Sweden’s Pirate Party.

- Bitcoin’s Four Hurdles: Part One – Usability, Part Two – Transactions, Part Three – Escrow, Part Four – Exchanges. A series of articles by Rick Falkvinge on the difficulties faced by Bitcoin.

- Joining Clouds. An interesting account of the origin of the ideas in the design of Bitcoin, and how this design can’t be regarded as elegant from a cryptographic and engineering point of view.

- Bitcoin? A sceptical view on Bitcoin by Viktor Grishchenko.

- Geld aus der Steckdose An article by Christian Stöcker on German magazine Der Spiegel.

- A very good guide on how to build a Bitcoin Mining Rig Cluster

And, finally, two books by Murray Rothbard that help understand the nature of money and the problems with fiat currencies. I’m pretty sure I wouldn’t be so sympathetic to the Bitcoin idea if I hadn’t read these books.

- The Mystery of Banking. A classic book by Murray Rothbard, which is available online thanks to the Ludwig von Mises Institute. Rothbard brilliantly explains how central banks, and in particular the Federal Reserve in America, came about and how fractional-reserve banking works. Even if you don’t completely agree with Rothbard’s Austrian view of the superiority of gold over fiat money, I think anyone who wants to understand what money is and how the dynamics of money creation works should definitely read this book.

- What Has Government Done to Our Money? Another brilliant book by Murray Rothbard, where he criticises the Federal Reserve system. As with The Mystery of Banking, while some of his opinionated views may be debatable, Rothbard succeeds at explaining how money works and how the Federal Reserve causes inflation. Rothbard’s views also help to understand the mindset of those who think that a money not issued by a central bank would be a better store of value.